|

Listen to this article

|

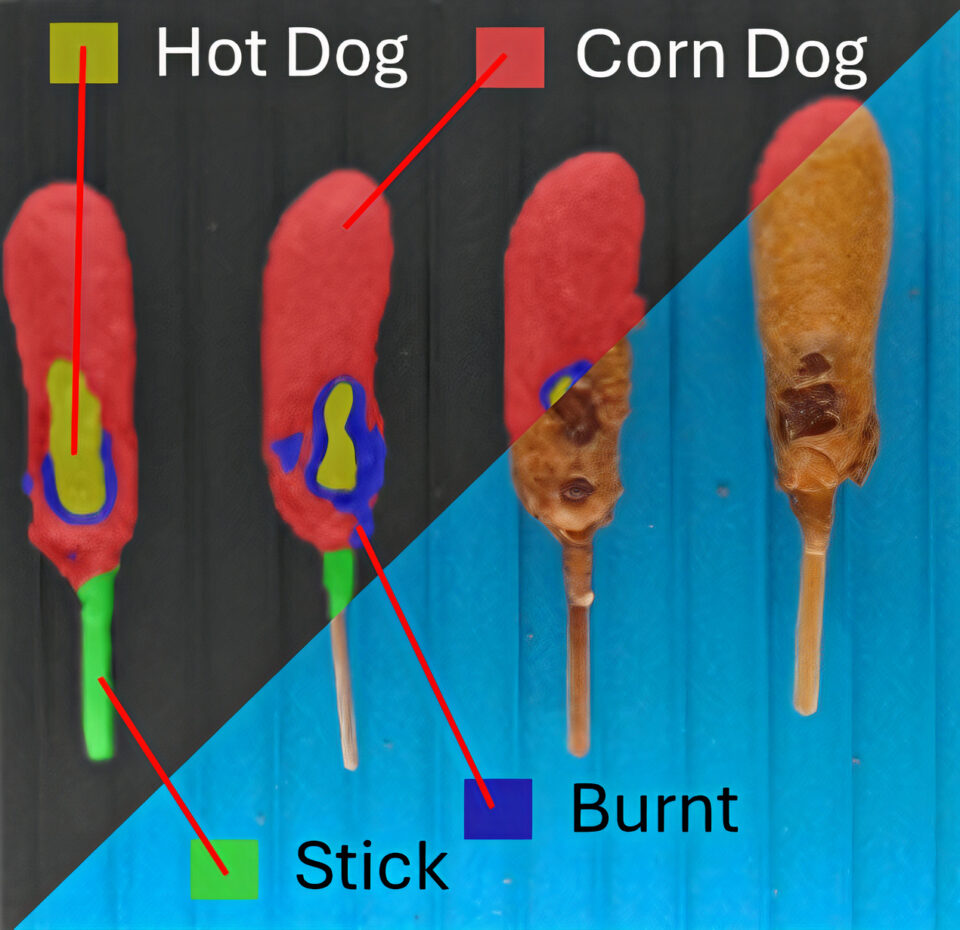

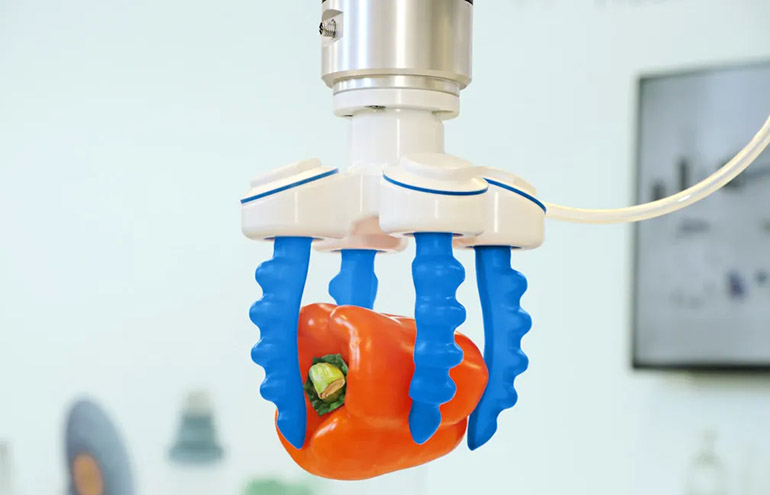

Soft Robotics spinoff Oxiptal AI’s vision tech can detect bruises on produce, excess fat on proteins, burn marks on snacks, and more. | Credit: Oxipital AI

After two straight record years during the height of the COVID-19 pandemic, industrial robot sales have crashed back to reality, especially in North America. According to industry association A3, sales of industrial robots in North America declined 30% in 2023. Sales dipped 6% in North America during Q1 2024 compared with Q1 2023.

While many analysts agree that industrial robots will eventually become ubiquitous, the timeframe for that happening remains unknown. The slowdown is partially responsible for several robotics companies shutting down or laying off staff. Mark Chiappetta, president and CEO of soft gripper maker Soft Robotics Inc., was determined to not fall into that category.

Soft Robotics today divested its soft robotic gripper business to J. Schmalz GmbH for an undisclosed amount. Glatten, Germany-based Schmalz is a leading developer of vacuum technology, making everything from suction cups and vacuum generators to complete gripping and clamping systems.

Chiappetta told The Robot Report that Schmalz is acquiring Soft Robotics’ intellectual property as well as a number of employees and facilities.

“When COVID was happening, the talk was, ‘We don’t have a choice. [Installing robots] is a matter of keeping up with demand,'” he said. “We all fully expected those buying habits to stay, which would’ve led to a tectonic shift in robotics. But those habits didn’t stay.”

Soft Robotics was founded in 2012 by Dr. George M. Whitesides of Harvard University. He envisioned the use of soft materials and microfluidics to change the way robots were made, opening the door for new markets and applications. He keynoted the inaugural Robotics Summit & Expo, produced by The Robot Report, in 2018.

Oxipital AI diversifies the business

While Soft Robotics’ grippers are now under the Schmalz umbrella, the company is no longer. It has spun off its mGripAI 3D vision and artificial intelligence technologies into a new company called Oxipital AI, for which Chiappetta holds the same job title.

Oxipital AI will focus on visual inspection tasks such as defect detection, volume estimation, SKU classification, attribute segmentation, and conveyor counting. It will also on robotic picking in various industries, starting primarily in the food business where Soft Robotics had built its reputation.

The company plans to create core object models that Chiappetta said are pre-trained using 100% synthetic data. He added that Oxipital AI requires zero imagery to be gathered, nor does it need human labeling.

A no-code feature enables customers to set rules for what constitutes a good product or bad product for inspection tasks, and a cloud-based dashboard collects and analyzes real-world data, he explained. Oxipital AI’s technology stack interfaces with all existing industrial robot arms, as well as conventional automation systems such as conveyors, said Chiappetta.

Oxipital AI is a new company focusing on AI visual inspection tasks. | Credit: Oxipital AI

Food industry forces Soft Robotics shift in focus

Besides not selling robotic grippers, the main difference from the former company is that Oxipital AI will have a major emphasis on applications that don’t use robots, he noted. For example, in the food industry, AI-based vision technologies can improve yield, increase throughput, and reduce waste, Chiapetta said.

“Food processors aren’t ready to rip out human picking lines and replace them with robotic lines,” Chiappetta said. “They are willing to put in a camera to expose how to optimize their current processes.”

Chiappetta said floor space is the biggest reason food processors aren’t adopting robotics. Most of the larger organizations, he said, are built by acquiring smaller producers. This makes every manufacturing plant different and puts floor space at a premium.

Another major problem, according to Chiappetta, is that food-processing companies are reluctant to take the initial leap of faith into robotics.

“[The food industry] hasn’t been a strong adopter of robotics to date,” he said. “Processors need to allocate capital with high interest rates, select a bidder, have a solution developed, take an existing line down, put the solution in place, have acceptance and quality done, and then they’ll know if the investment was worth it.”

“Once you take out humans, it’s hard to go back,” said Chiappetta.

He said on LinkedIn that Soft Robotics had nearly 1,000 soft grippers deployed in the field.

OnRobot is another well-known developer of soft robotic grippers. Founded in 2015, the Odense, Denmark-based company initially offered a variety of robotic end effectors.

However, it too has diversified its business by launching various sensors, tool changers, and software packages for applications such as palletizing, packaging, CNC machining, and more.

Former Soft Robotics divests in move to AI

The Bedford, Mass.-based company has updated its website to reflect the new direction. One page details how a “leading sweet corn producer in the United States” recently implemented the AI-powered vision technology to inspect its produce for defects.

This system looks for various flaws such as missing kernels and misshapen or undersized produce. It then relays this information to the quality control team for necessary actions.

Why did Soft Robotics divest its gripper business instead of just increasing its focus on 3D vision and AI?

Chiappetta replied that this wasn’t an “adapt-or-die” situation, but that the increased cash from the divestiture certainly helps. The main benefit is to keep the company focused, he said.

“Robotic picking is really hard, and grippers are a niche business,” said Chiappetta. “The visual AI needed to do these things is the common denominator to do all these applications. And we’ve got the tech to do it.”

“Without focus, it’s difficult to survive,” he added. “I had many conversations with strategic partners and others who didn’t know how to look at a company that’s eyes (vision), hands (grippers), and brains (AI).”

Not 100% dependent on robot sales

December 2022 was the best month Soft Robotics ever hard financially, Chiappetta told The Robot Report. January is typically a slow month as companies figured out their budgets, but January 2023 was horrible, and February didn’t get any better, he said.

“Our partners were seeing the same thing,” recalled Chiappetta.

Soft Robotics last raised $26 million in November 2022. It had raised $86 million since its founding, according to Crunchbase.

Soft Robotics’ business was 100% dependent on robot sales, but Oxipital’s won’t be, Chiappetta asserted.

“The Schmalz transaction is the start of what we hope is a strategic partnership,” he said. “They have a great reputation and global distribution. It’s a natural fit for us. We need a company like Schmalz to grow soft robotic grippers. And the more soft gripping becomes the standard, the more opportunities we’ll have for our AI vision tech.”

Schmalz had developed its own soft robotic grippers, such as the OFG HYG SI-70. Source: Schmalz

Tell Us What You Think!